Do you want to schedule a time to call them together and ask why your claim was denied?

I am not an expert on disability requests, but I would like to learn more.

Feel free to DM me if you want to schedule a time to call them.

Yes for sure for Friday if that is possible.

I live in the Eastern time zone. Does sometime between 1:30 and 3 p.m. ET work for you this Friday?

-Thomas

Yes that would work.

I’d be interested to know what happens. I was denied total and permanent disability several years ago and though I borrowed 98k before I got sick I now owe 272k.

An amount I will never be able to pay as I have now been on disability for 10yrs.

I was approved for TPD and just came off 3 year monitoring. I’ll gladly help any way I can. Let me know and feel free to dm me.

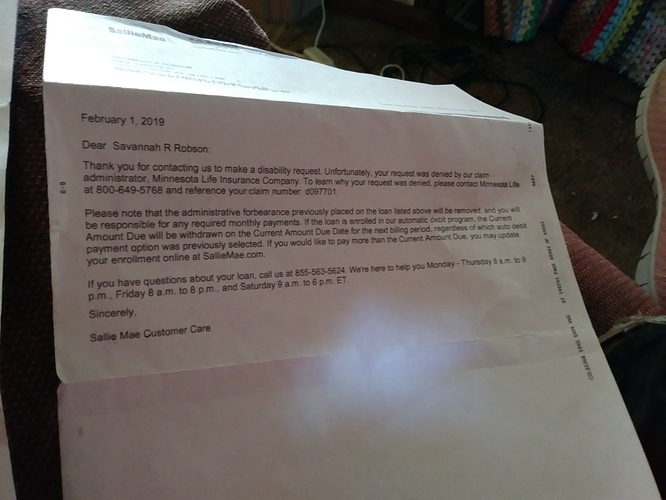

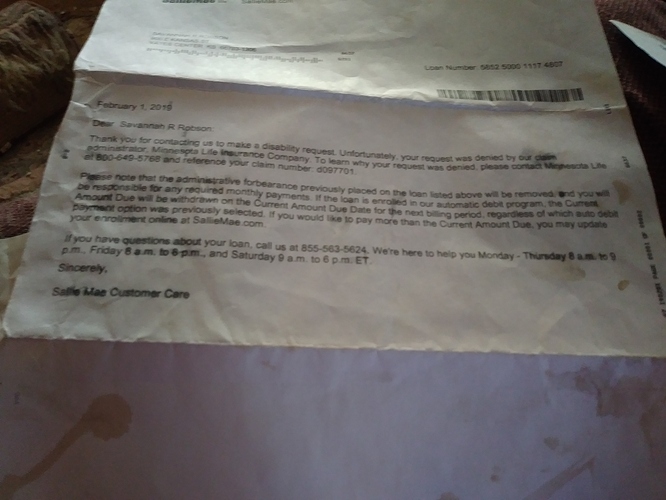

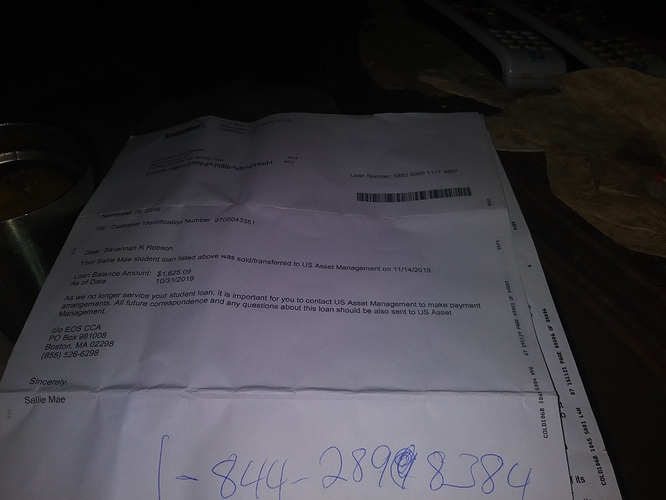

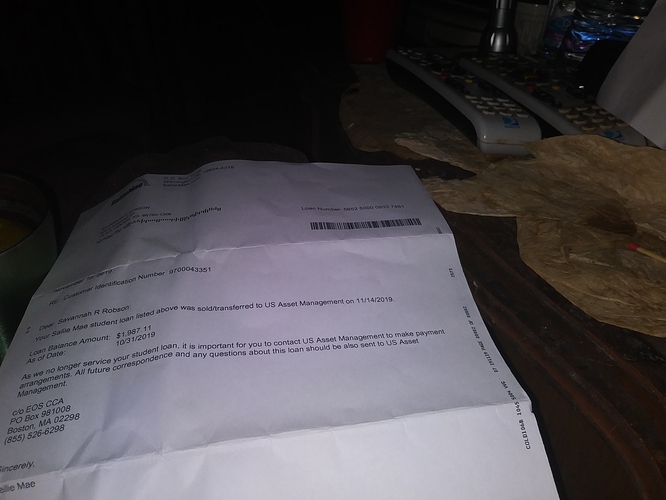

I just noticed the letters are from Sallie Mae. Sallie Mae is private loan company. They are ruthless about denying discharge. Private creditors absolutely cannot garnish SSDI for any amount of debet and courts will tell them to leave you alone should they try to sue. I have dealth with them and their debt collectors for 5 years now. I sent a letter to the last one and told them to cease and desist. They cannot do a thing to you.

It debt is federal loan debt, they can garnish social security and ssdi. Even they can’t touch ssi though. Please appeal. Make sure your doctor does necessary paper in the application if your ssdi reviews are spaced less than 7 years apart. The doctor must do this in a way that shows you can do no kind of work to repay they loans, even in the field for which yiu went to school.

My doctor certified my worsened disabilities after I busted up an ankle and could not longer even finish my degree. I’m also now 62 so my age is against me finding a job even sitting as well.

Good luck!!

Glad to have your expertise when it comes to TPD. I’m still learning but learned a lot in the last week working on this.

Yes they are. Thanks for the feedback.

You’re most welcome. I’ve been dealing with this stuff enough and learned a lot. I also sought an attorney’s advice on it. He said tell them to go blow basically as there’s nothing they can do. Social Security and SSDI can be garnished for federal loans, so be sure to appeal. They cannot be garnished for private debt of any kind, so you’re pretty mich judgment proof.

Afternoon Thomas,

I recently received my letter from DOE, stating 0% of my ITT Education federal loans were to be discharged from my borrowers defense to repayment after 5+ years of waiting for a decision. They didn’t state the reason for denying my request. Are there any options available at this time to request a review or demand reasons for the denial? I have Nelnet as my servicer.

Thanks

Hi @Garrett_Shuck, this has happened to A LOT of people. The options available to us depend largely on what the results of the election next week are. I’ve written the best update I can for where things stand at the moment here:

I got denied because of an pre existing condition.

I know I enrolled in automatic small payments and because my payment went out the 21st instead of the 15th they had the nerve to say I violated the agreement and the expect me to pay them over $800 I am only on disability I couldn’t afford that and had the nerve to ask if I had any help paying which I didn’t at all then they turned it over to an collection agency.

I have kept everything from and I have my bank statement for proof too.

That was last year that Sallie Mae did that they like my 142 payment that they got from me but I was told I violated my agreement.my bank statement showed I did make an payment to them.

I too was denied due to pre existing even though I am worse now. I’ll never be cleared to work even if I were able to finish a degree, which I’m not able to do.

They cannot do anything to you with it being private debt and you’re on disability. Just don’t bother with them at all. Quit making payments. The more you try, the more they will harass you. I promise, they can do nothing. I am on ssdi as well and they cannot touch it. This is from my experience and an attorney.

I am on disability and can shed some light given I was also denied a student loan discharge and here’s likely why you were denied. …I don’t know what the Minnesota Insurance thing is, but when you’re awarded Disability, the SSA will automatically contact the DOE for discharge unless you only THINK (like I did) that when you’re granted Disability benefits, that means you are permanently disabled which is not true.

Your SSA determination should state when your next medical review is, which can be either 2 to three years or 5 to 7 years or never. If your review is 2 to 3 years, then you are not considered permanetly disabled and your student loans cannot be discharged and you will likely have your benefits terminated at your next review…like I did.

If you’re not a veteran and have student loans, you’ll never be declared permanently disabled in order to prevent loan discharge.