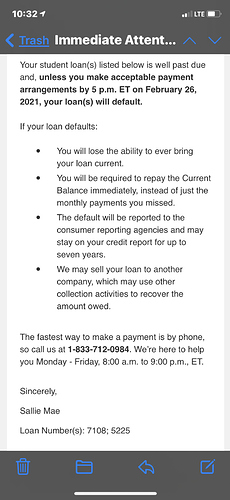

They are threatening me to default my loan even though I pay them what I can every month. I don’t know what to do. If they garnish my wages then I’ll be on the street.

Horrid. So this is how Sallie Mae is “assisting” it’s borrowers during the pandemic. I’m so sorry, Nate.

I’m reading through their student loan help options and it’s just appalling how predatory it is. However, it’s important that you be stubborn for your case. Have you asked for a forbearance yet? If you still can it may be a good option right now. In any case, you need to fight for terms that work for your situation.

You will get hard pushback. They will tell you ‘no’ the first umpteen times. Keep pushing your case and do. not. cave. They are trained to do everything in their power to make you give up and bend to their terms. They depend on you to give up. Fight them.

Personally, I’m here to help in any way I can. There are people on here with experience loan striking and fighting off collections and servicers as well. I’d highly suggest asking them for advice. Be strong and stay safe.

I have been paying for years. Then my contract expired and interest shot up from 2% to 14%, payment went from $140 to $650/mo.

I have pleaded with them but they have added fees nd interest that completely wiped out what I already paid.

If they garnish my wages, I won’t be able to afford rent. I’m sure I’ll lose my job if I don’t have a place to live too.

who can help me fight? What do I need to say to them when they call?

One thing that can help get leverage over them is to tell them your monthly income versus your monthly expenses. This establishes what you can and cannot realistically afford. Explain your situation. It may help to mention the pandemic and any possible hour or pay cuts. Assert what you need to stabilize your situation and stand by it. If the one speaking to you says no, ask if there’s anyone else you can speak with to appeal your case. If they respond with “they’ll tell you the same thing”, tell them “that’s alright, I’d still like to speak with them”. You must be politely stubborn with them.

I know @Thomas_Gokey volunteers debt disputing advice. He may be able to advise you in depth.

I can’t really give advice. These are tough situations and I don’t know what to do, and can’t really tell anyone else what they should or shouldn’t do.

This looks like it is probably a private student loan @DrNate

You might want to reach out to a local legal aid society for professional advice.

The benefit to corresponding with them in writing, instead of calling them up on the phone, is that you have everything they tell you in writing. They might say something on the phone that is confusing, or misleading, but since you won’t have it in writing, it can be hard to fight.

You can always negotiate a private student loan. If you can’t pay, you can’t pay. There isn’t really anything either of you can do about that. You can always negotiate. They are trying to scare you with these threats, but all they really care about is making a profit. You have real power and leverage. You could ask them to reduce your debt to something reasonable. Not just reduce the monthly payment, but the principle itself. They might say no, but private student loans do get settled for lower amounts sometimes because it is Sallie Mae’s best interest to do so as well.

We do have a dispute tool for private student loans, but that is really designed for people who are being collected on after default, and we haven’t had much success disputing private student loans because they are so difficult. I wish we had better options.

Thank you Thomas. I appreciate your willingness to help

Dr. Nate, Sallie Mae hassled us daily for years… at one point they were calling us 9 times a day. We have $300k in debt between my daughter and us. We finally decided, well first of all it was illegal for them to call us like that and when we told them it stopped. But we decided there is no way we can possibly pay this debt, so we don’t. We did try to refinance it into where we could pay what we could based on income but even that came to $1100 a month. So finally we filed to put the entire debt on hold. That was when good ole Betsy was in office. Of course she did nothing. My daughter joined the Harvard Project and became one of the 7 listed on the Class Action Suit against Art Institute. And now all loans are in forbearance according to the news. So file for forbearance. I sincerely believe that there has to be a Jubilee (all student debt forgiven). I’m the parent of a student and I feel that we have sold our children into debt slavery. It has to go. Good luck to you.