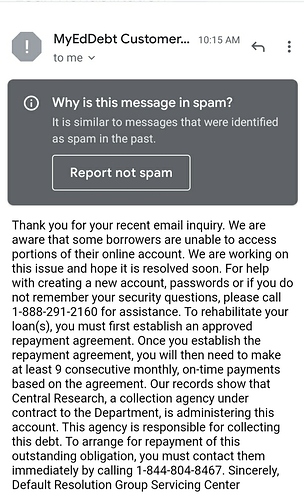

I’m guessing these are federal student loans? Can you confirm that? Or is there a chance these might be private student loans? I’m guessing they are federal because it looks like Central Research is one of the debt collection companies the Dept of Ed hires.

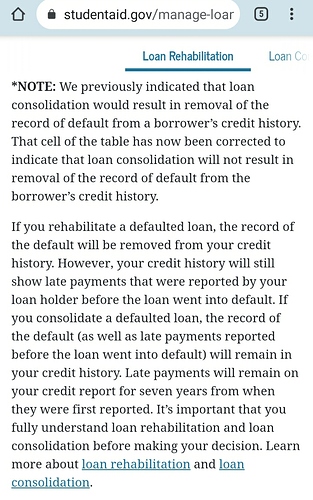

You can sometimes negotiate a settlement for private student loans, but you can’t really negotiate federal loans at all. If these are federal loans one option worth exploring is consolidating your loans, which would bring them out of default. Then you can apply for an income driven repayment plan. Since you are currently unemployed, your monthly payment would almost certainly be set to $0 a month.

There are many advantages to going this route. It basically keeps you on strike (i.e. paying nothing) but removes this account from default status, which means it should be put back in good standing on your credit reports. It will also keep these debt collectors from harassing you. There is some paperwork involved, however, both with the consolidation and the application for income driven repayment.