I guess under those terms I am already on Strike as my IBR is $0 a month. It appears to be pretty easy if you have kids as one requirement is you must provide more than 50% of your child’s support. At least with my loan company, I just had to write an email stating that my two boys receive more support from me than their moms. My loan company did not check and did not ask for any proof. In my case this is honestly the circumstance (I have my boys just under 50% of the time, but provide more than 50% of their support). I think just about anyone can claim this (married or not) as long as their spouse/partner is not claiming the same amount of support.

Hi Michael - Yes you are. Please join the campaign!

Ann

Hi everyone,

Thanks for this space and conversation. I am from Canada, am 30 years old and have about $90,000 in student loan debt ( federal loans) and $17,000 in credit card debt. I come from a small northern community where secondary education rates are low and people are encouraged to skip school in order to work in oil and gas. Despite years of industry representatives giving presentations in our education system about the drawbacks of further education and the benefits of industry, I still knew from kindergarten I wanted to go to this thing called “university”. I come from a very low income and trauma affected family but found school a place of gratification and safety.

I got by on federal loans, bursaries, scholarships and service jobs. I decided to do my masters in Counselling Psychology on student loans. After completing my masters and working for over 10 years in non profit frontline work, I was officially burnout and needed to step back to start processing my own childhood and examine myself in order to truly help others again.

I worked in cafes, a lobster boat, travelled the east coast, and began my own trauma work in that year of letting go and healing. I would often have small heart attacks when I used my credit card for basic things, but knew it was for my overall health to do the emotional work that was needed, much of my debt now comes from healing and therapy.

Though intellectually I have always been extremely critical of our current financial system, and would refer to my student loan debt as “monopoly money” (could be flimsy pinks and greens if I cared), as an activist and idealist for alternative ways of living, I still really have struggled at times with the shame of this debt! I can feel dominant narratives seep in, I am caught comparing myself to my peers, and I can feel like quite a failure though I intellectually know none of this is true and our system is so broken. So the shame is real, and as I continue to grow and learn about my old shame stories this debt has so much of a lessened grip.

I have had positive experiences here in Canada, calling a non profit debt agency who actually helped me understand my real problem has nothing to do with money but with my own right to basic needs, which I think rings true for our western economic system. Thanks for listening and sharing, I am so thrilled to connect to this community.

Hello, and thank you for creating and offering this space for me and others to share our troubling stories of a flawed system.

My preferred name is Samantha Lochs, and I live and go to school in New York City. I moved here to get away from my very emotional abusive and controlling mother, as well as my very depressive and suicidal life in Florida. I am very close to graduating; but I’ve been struggling with wanting to drop out for years now. I’ve accumulated 35K in federal loans and 15K in private loans, and 4K in credit card debt. My mom helps me with half of my living expenses, but refuses to pay my tuition. My dad is co-signed on my private loans but I doubt he will actually ever help me pay them off. All me and my mom do is fight over finances and honestly, I hate her. I want to drop out so badly because what’s the point in me graduating and putting myself in so much debt if I’m just going to be stuck working a restaurant job my whole life trying to pay this shit off.

I have worked my entire time thoughout college, I’ve even taken some unpaid internships which have led to jobs. But my boss does not pay me enough money for me to pay my bills (I barely earn $300 a month), and he refuses to give me a raise despite him owning his own animation company, and just recently buying a new apartment in Manhattan. I’m constantly spending my money on bills and it feels like a never ending painful cycle.

I don’t know what to do anymore, I wish all the time some financial miracle would come along and make it disappear. It’s so hard for me to stay motivated in what I want to be doing when this debt seems to be the only thing growing in between my wallet and me achieving my goals.

Hi everyone!!!

Just want to say thanks again to those that have shared their story here.

Each voice matters and ever story, IMHO, reflects the crisis we face. Please remember YOU ARE NOT ALONE and YOU ARE NOT A LOAN.

At this time, we have a real chance at changing the fate of every single current and future student debtor. https://youtu.be/CyPViM6FcVA

So!!! Please get warmed up and ready to tune into the platform more. We are going to  announce our campaign to win College 4All, in just days.

announce our campaign to win College 4All, in just days.

here is a sneak peek

RIGHT NOW, we are building our social media team. You are all invited to join us. If you are interested, please follow the link to our community thread- SM Team

#solidarity

Dawn

My name is Steve, and I have been struggling with student debt for a while.

To begin, it was technically my parents that had taken out a parent plus loan for my schooling, in addition to me taking out federal loans that I paid off recently. The private loan is still alive and thriving ($30,000) from my schooling 12 years ago.

I paid the minimum on the loans because I couldn’t afford much more (without an actual job I thought I would get), and when the loan company said they would jack up my loan payments to double to be able to pay this loan off in my lifetime, I had to make a move, go broke, or risk defaulting on a loan under my parents’ names.

To make the debt more manageable, my parents (not having a mortgage) took this debt on as a home mortgage. This drastically reduced the interest and payments, but now that it is not in its original form, I fear that I would never have a chance of getting anything out of it, despite still suffering the effects.

Hello, My name is James and I haven’t personally had to much issue with maintaining my student debt, but the real problem lies with my mother.

I started with $23,000 in loans and then she had to take out an additional $27,000 (if i recall correctly) herself. There was a point where we both defaulted when Sallie Mae had our loans, but since working with Navient’s IBR Plan I have been able to maintain my loan payments (more on that later) however my mother has once again defaulted on her loans. She is now in her 60s and unable to retire because of these loans.

I have always felt personally responsible for her situation and have been trying to take them on for her for a while now but no such luck with any lenders is to be found. I would need to make them my loans so I could consolidate them and begin a new IBR plan because just giving her the money for the payments is far too expensive for me. They have garnished her wages, destroyed her credit score, harassed her at work (thankfully her boss is understanding in that department) and have even called outside family members to try to get her to make payments she can in no possible way afford.

As for me, my IBR has been approved for $0.00 payments and has been that way for a few years now because I make so little income to begin with as a freelancer. I freelance because the last full-time employment opportunity I had I quickly realized that although I have a bachelor’s degree from NEIA in Brookline, MA (closed now, granted bankruptcy) I still very much lacked the education it took to perform in my career. So much so that my last employer bumped me down to an entry level job so i could learn everything over again and I could still get minimum pay for my time. Unfortunately, after three years they let me go because they were down-sizing and had no extra room for me. I survived the 1st wave of layoffs, but not the 2nd.

I have been freelancing Web Development services from home ever since, making a modest $700- $900 a month, where my girlfriend pays all the rent on her own. So although my personal loan situation is not nearly as bad as it can be (or as my mother’s is right now) I need to get these loans discharged for both of our sake, but mostly for hers, she shouldn’t be saddled with this responsibility.

Hi James, Welcome to the debt collective. Thanks for sharing your story. Sorry to hear about your mother’s situation. This is infuriating on so many levels. This should never have happened to her or to you. It is not your fault. The system is rigged against us.

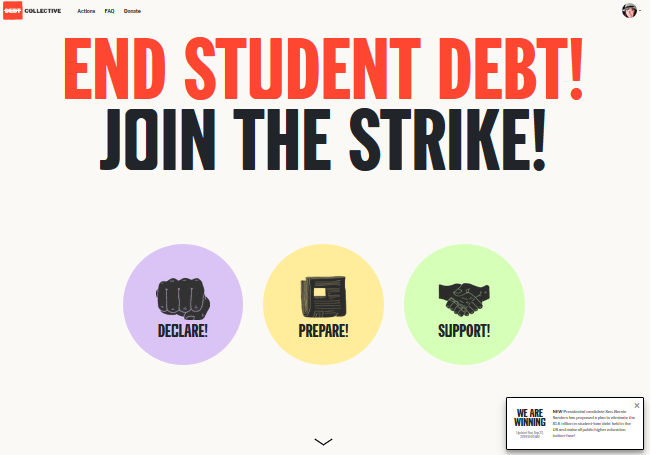

Since you are paying $0 on your loans, you are officially on strike. We have a strike campaign that is about to be launched to the public. https://strike.debtcollective.org/

I hope you join the strike and share the word with anyone you know in a similar situation. Once you join, you will receive a list of actions that you can take to help us win student debt relief.

Solidarity!

My name is Kwame and I have $50,000 in student loan debt. I went to college off and on, mostly part time for 10 years to get my degree. Even working full-time, often two jobs, sometimes three I had to get loans every semester to pay for school. But I did it because I was convinced that it would all pay off when I finally had that degree.

I graduated in late 2009 with a degree in Industrial Design and things were looking up for a while. I got a job in my field almost right away and although I wasn’t being paid what I should for my position and market I was doing interesting work and I thought I was starting a career. I worked there almost 10 years and was underpaid the entire time. Nickel and dimed everytime I brought up salary and made promises of salary parity at some vague point in the future. Then mid least year they called me in, told me they were in extreme financial trouble and would have to cut my pay 10%. That was the final straw. That 10% cut put me 35% under market. I was unable to pay my mortgage and was forced to sell my house and move out of state . I had been job hunting for almost two years at that point and it was becoming increasingly clear that no one was interested in hiring me. I don’t know why. I did good work. I have 15 design patents, designed over 400 products in that time, a handful of which are bestsellers on Amazon. These days I scrape together a living working retail and gig economy jobs. I couldn’t make those loan payments even if I wanted to. My $50k degree isn’t worth the paper it’s printed on.

The kicker for me is I’ve been paying my loans every month for 10 years. $600 a month for a decade and the principal is the same as when I started. I was just throwing money into a hole in the ground. I’ve had enough.

Hello,

I enrolled in college at 40 years old. I was a single mother of two at the time and that was in 2002. I began in a local college, then transferred to an accredited online school, where I earned a BBA by 2006. Before college, I was earning $12 an hour at a local hardware store and today, in 2020, I work in a large maunfacturing company, doing what I love, but I am only earning $17 an hour.

So in an 18 year period, I have only increased my wages by $5 an hour. The colleges promised my income would double at graduation and I never even got interview calls. Where I work currently, did hire me because of my degree. Today, I do not earn enough to pay for the $77,000 student loan debt or the $296.00 a month they want, based on my household income.

I was still a single parent when I graduated, but federal government is punishing my husband and force him to co-sign my renewal application every year when I apply for the income-based repayment loan. When I have called in protest to these high payments, the collection debt does not care that I have rent to pay or a car payment. The debt-to-income ratio on a federal level is ridiculous to say the least. They do not factor in current inflation versus current wages. I am now 58 years old and I am not able to even buy a home with this debt over my head. I keep deferring since I cannot afford the payments so I stay out of default.

My now 36 yr old son did not do a deferrment. He went in default and now he gets almost $200 taken out of his paychecks, they take his tax returns, and he lives in a one bedroom, low-income apt with his son because that’s all he can afford. He never even finished his associates degree and he is being severely punished, in my mind, for trying to improve his life 15 years ago.

We cannot wait until something is done!!! Thank you for giving us hope!!

Hello I’m Nichole,

I took out approximately 80k in student loans, half federal half private. Would have been less but when the market crashed in '08 I had to take more just to finish my degree. I have a bachelor’s in Art with a concentration in animation (specifically computer animation). I always hear “that should get you a great job”, it didn’t. It is an extremely competitive field and I graduated when a lot of the smaller animation studios went under. No one was hiring, I could do an unpaid internship but with loans coming due it wasn’t happening. I couldn’t even get my portfolio in the door, it sent me into a spiral of depression. When things began to get better I was in competition with a lot of experienced animators. I’ll admit I stopped trying, I was way behind on software and I would go months without even picking up my sketchbook. The depression and anxiety were very real. Eventually I stopped putting off life, we have two beautiful boys now. But in the process of trying to pay these loans off while working low paying jobs has led to three bankruptcies. I put almost 37k toward my private loans and it didn’t put a dent in the principal. After the last bankruptcy I told my husband we weren’t paying the private and now were playing financial chicken with National Collegiate. I’m honestly over all of it. The interest rates, the tuition costs, its ridiculous. I told my son if he wants to be an animator/artist I’ll teach him, he doesn’t need a degree for that field anyway.

I’m somewhere in the neighborhood of $50K in student loan debt with the interest continuing to grow. If I knew what I know now I would have dropped out years before finishing my degree which got me know where in the real world. Guidance counselors, college deans and all staff that were there to ‘help’ pushed me to stay when I didn’t have a future based on the education I was there for.

I ended up becoming a felon while attending school early on with a plan to go onto graduate school. I could never get accepted to a post grad school because of it and before anyone gets the wrong idea, I never was arrested. NO jail or prison time. That didn’t prevent the school from telling me I can still use the degree to get a job. I was in an undergrad program for Exercise Science/Kinesiology.

My taxes were collected in an offset last year and now with tax season beginning this year my anxiety is getting the better of me. I paid very little in taxes and am sure I will owe this year. I keep making arrangements for my loans so I don’t default and then the loan moves to another creditor and it takes weeks to months to find out where it is and that all the paperwork I had done was for nothing.

I am the only income for a family of 6 but I can only claim 1 child and my spouse. The other kids live with me anywhere between 3 to 6 days a week but am not able to claim them and on top of that I pay for their school items and programs but tax wise it means nothing.

Saying that my student loan debt is crippling is an understatement. I can’t make my monthly minimum payments and I am looking for others that want the madness to end. No one trying to have a career should be forced to take on massive debt with very low success in having a future in a field that was studied.

I took on almost $ 200K for two graduate degrees. My earnings went up, and I repaid about $80K.

My circumstances changed, and I haven’t paid anything in years. And I’m not going to.

The banks took on a bad loan in my case, and they should write it off. I’m not even fighting them. I see it as a vow of poverty in exchange for a good education.

Update: It’s February 8th 2020. I am in debt for student loans (around $50,000+) graduated in 2017 from a for profit college. I am 29 years old. I have $2.50 in my apartment.

I can’t afford basics of rent and a phone each month.

I haven’t been able to hold down a job related to my field of study.

There are not many jobs in my field, which is contradictory to my college’s marketing.

I have a disability which makes my job application process a much smaller number of places.

I have a marginalized identity, which makes my job application pool even smaller.

My financial duress is increased because of a recent divorce.

I am on food stamps and medicaid. My food stamps will run out in April because of arbitrary federal mandate that I have to work a certain number of hours a month to qualify for the ability to eat.

My cosigner has been paying my student loans each month and I am lucky for their gracious actions. They want me to pay them back when I get back into financial stability. I let them know I am paying them back when I can afford to.

I want to debt strike, but my cosigner’s credit would be adversely effected if I did, and there are things that are important to their survival in their credit score.

I’m currently seeking for a job every day, maintaining my mental health, physical health, and keeping my spirits up, despite all reality is telling about my hopes for a future.

Thanks America.

Hello;

First, I want to say, Thank You, for providing a place where people can come together in solidarity, as well as in solace. I “know” there are people like me out there, but it’s another thing altogether to be able to see their stories first-hand and share in their hopes for a better tomorrow.

I went back to school at the young age of 45. I had always wanted to complete my Bachelor’s and then perhaps go on to my Master’s. As a would-be social worker, I recognized the need to finish my degree so that I could advance further in my field. When I first applied to go back to school, I was not married. When I began to attend, I was (I had to wait a year for state residence requirements) and the school let me know in no uncertain terms that because my wife made more in her early retirement than allowed, I was not eligible for grants or scholarships through the school. That’s right - my wife was receiving retirement benefits from the County (retired early) and because she made over the threshold, I was told I no longer qualified for grants. To add insult to injury, I was told I could divorce my wife since we were only a year married and that I would then qualify. I was devastated, but plugged along because I needed to complete that magic degree - right?

Since I was not eligible for grants and scholarships, I had to pay out of pocket for books and other necessities, as well as parking pass, food, and so on. So I pulled out that magic credit card - they don’t tell you that you cannot consolidate that card with loans later on down the line because it’s a personal line of credit. Yay!

The two and a half years to complete my undergraduate cost 24k just in loans. I was invited to apply to my Master’s degree program by one of my professors - I was immediately accepted into the program. Without hesitation, I signed the loan docs for the Master’s program and was awarded the full loan - another 42k. Yep, just in student loans, in 4.5 years, I walked away owing 66-thousand dollars.

I graduated in 2016, just about 4 years ago, but I had to get a job in a similar field than my degree so that I could accrue hours that I could eventually apply to my license. That means, for those who know, one is hired in a menial position with little to no pay (at least not what one is worth), just so one can begin to pay bills. Last year I was finally licensed in my field (3 years later) and am now beginning to see the fruits of my labor - but it is not without some difficulty. My payments to the Great Lakes is about a third of my income just to pay down the INTEREST on my loans. To date I have paid off over $16,725.00 in interest with little to no dent in the principle. My calculated pay-off amount today is the same as it was 3 years ago when I began paying on my loans. And that does not include the money on my credit card from books and other costs.

I am now 53 and am looking at the prospect of not being able to retire until I am at least 72 - just so I can pay off my loans.

The worst part is, that had I known at the time, I could have gone to Mexico with my mother’s citizenship and gone to school for free. That’s right - Mexico offers free university education, but the USA does not. Yes, I would have to have paid for books and sundries, as well as other administrative and education costs, along with housing - but I would not have had to pay 66k for my education even with all those things! That, to me, is very sad - that a “s***-world” country can offer low to free cost education, but an alleged “first-world” country cannot (or will not).

I’m not in as bad of a situation as many stories I hear and have read, but I think of how much of that 16k I could have put back into my community in food, clothing, car repairs that have been forgone because of the student loan debt. However, am not in a position where I can just stop paying on my loans like many have done. Having my own business and a house means I have to pay to maintain my credit ratings just so I can survive in this cut-throat game of debt resolution.

Thank you, for providing an open place where people can share their stories.

Hi, I’m Annette. I graduated with my master’s degree in 2011, with about $145,000 in student loan debt, both private and federal loans (mostly federal). My private loans have all been paid off, and i now owe $156,000 because of interest accruing over the last 9 years and being on a payment plan since I consolidated my loans. If I wasn’t on a payment plan, i would owe upwards of $1800 a month in my student loans, which is more than what I pay in rent.

I’ve been part of the student loan forgiveness plan for the last 4-5 years, but according to the government i won’t reach my 120 payments until 2024, which is inaccurate because I started paying on my loans in 2011. I have no hope that the forgiveness plan won’t implode on itself, and I’ll be stuck with this debt until I die.

I’m fortunate in that I have a good paying job, with great health insurance, and I can afford to pay my loans each month and survive and build a small savings. But at this rate, I’m at the point of leaving the non profit sector and the forgiveness plan to get a job in tech to make more money to actually be able to pay my loans off. There is literally no light at the end of the tunnel for me when it comes to my student loan debt.

Hello, I’m Jamey. I have almost $140,000 in student debt, the majority of that being from my MSW (master of social work) at a “nonprofit”, private university: Loyola University in Chicago.

I took out these loans planning to utilize the Public Service Loan Forgiveness, a plan that was crafted several years before the first eligible borrowers should have earned forgiveness in 2017/18, and we learned a tiny minority did, and we learned this program is a sham. I currently work at a large, well-known nonprofit earning $33,000 per year. I have no semblance of an idea how I will get rid of my debt, which accrues godawful interest that I don’t have the heart to calculate. I want to strike, but my credit score is so average I struggle getting apartments with it. Whether or not I can strike immediately, I am here to organize and increase collective action for these issues. I would love to discuss this with anyone else in Chicago or Illinois, please reply if you are nearby.

Hey there! I’m in Chicago too and I feel you! I got my masters from DePaul University in 2017 with the hope of earning more in Chicago - especially (and also) at a nonprofit. I’m earning close to 67k a year but my student loan debt is around 120k right now which is about $1100 a month. Private and federal. Add in expensive housing in Chicago, car payment/insurance and credit card debt equates to living paycheck to paycheck for as long as I can remember. I have been discouraged to join the Public Service Forgiveness program because of the reasons you state. At this point, the only thing that’s given me hope is if Warren or Sanders takes office. They are the only ones who can make this right. Until then, I’m trying not to dwell on the fact of how different my life would be if half of my paycheck didnt go to minimum payments of my student loans. AND I was thinking today how if I didn’t have so much debt, I wouldn’t have to work a job that I’m not passionate about. My job is not want I want to be doing professionally and has NOTHING to do with my masters degree but I feel obligated to stay because I know the job I really want wouldn’t come close to paying my monthly bills/student loan payments. Sigh.

I have about 70,000 in student debt…started at about 30,000 and because of life it has more than doubled. I also am in public service field and becaz I consolodated before 2001, I am uneligible for loan forgiveness or any income based repayment plans. I was mistakenly put on income based and when I went to re-instate annually, I was told that I should have never received. My loan service is Great Lakes and I have been working on this since denied last year. I even had a Kansas leader , try to assist me…no good. Any one else going through this?