Hi everyone,

Thanks for this space and conversation. I am from Canada, am 30 years old and have about $90,000 in student loan debt ( federal loans) and $17,000 in credit card debt. I come from a small northern community where secondary education rates are low and people are encouraged to skip school in order to work in oil and gas. Despite years of industry representatives giving presentations in our education system about the drawbacks of further education and the benefits of industry, I still knew from kindergarten I wanted to go to this thing called “university”. I come from a very low income and trauma affected family but found school a place of gratification and safety.

I got by on federal loans, bursaries, scholarships and service jobs. I decided to do my masters in Counselling Psychology on student loans. After completing my masters and working for over 10 years in non profit frontline work, I was officially burnout and needed to step back to start processing my own childhood and examine myself in order to truly help others again.

I worked in cafes, a lobster boat, travelled the east coast, and began my own trauma work in that year of letting go and healing. I would often have small heart attacks when I used my credit card for basic things, but knew it was for my overall health to do the emotional work that was needed, much of my debt now comes from healing and therapy.

Though intellectually I have always been extremely critical of our current financial system, and would refer to my student loan debt as “monopoly money” (could be flimsy pinks and greens if I cared), as an activist and idealist for alternative ways of living, I still really have struggled at times with the shame of this debt! I can feel dominant narratives seep in, I am caught comparing myself to my peers, and I can feel like quite a failure though I intellectually know none of this is true and our system is so broken. So the shame is real, and as I continue to grow and learn about my old shame stories this debt has so much of a lessened grip.

I have had positive experiences here in Canada, calling a non profit debt agency who actually helped me understand my real problem has nothing to do with money but with my own right to basic needs, which I think rings true for our western economic system. Thanks for listening and sharing, I am so thrilled to connect to this community.

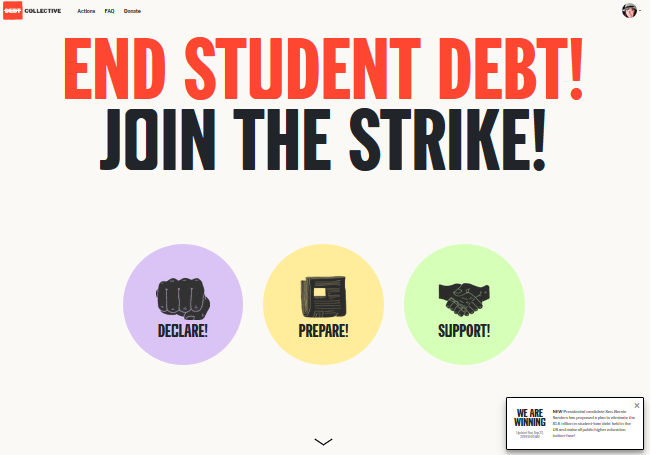

announce our campaign to win College 4All, in just days.

announce our campaign to win College 4All, in just days.