I recently found out my student loans were private and do not qualify for moratorium or for debt forgiveness for working 10 years at a non profit. Big shock to me cuz I work at a non profit full time and was hoping for debt forgiveness. My school financial aid officer told e I was given Federal Family Education Loans which are private but garaunteed by the federal govt. They no longer are in use. I have been told that I can Consolidate these loans and make them part of the William D Ford Federal Direct Loans Program. But when I contacted Studentaid.gov they told me I couldn’t. Can anyone give me advise on this. Am I screwed. I owed $80,000 when I graduated 15 years ago. Its up to $130,000. I would love some advice about what to do. They are in Forebearance now and growing. They all have different interest rates. IS there any chance for forgiveness for these even though they are private? should I start paying off the high interest loans? please help.

Check out this website: ForgiveMyStudentDebt.org

The folks who run it periodically give workshops on dealing with student debt. Although the PSLF is for government loans, when you get into the weeds there is information on FFEL loans as well, and you may be able to find some help. Good luck!

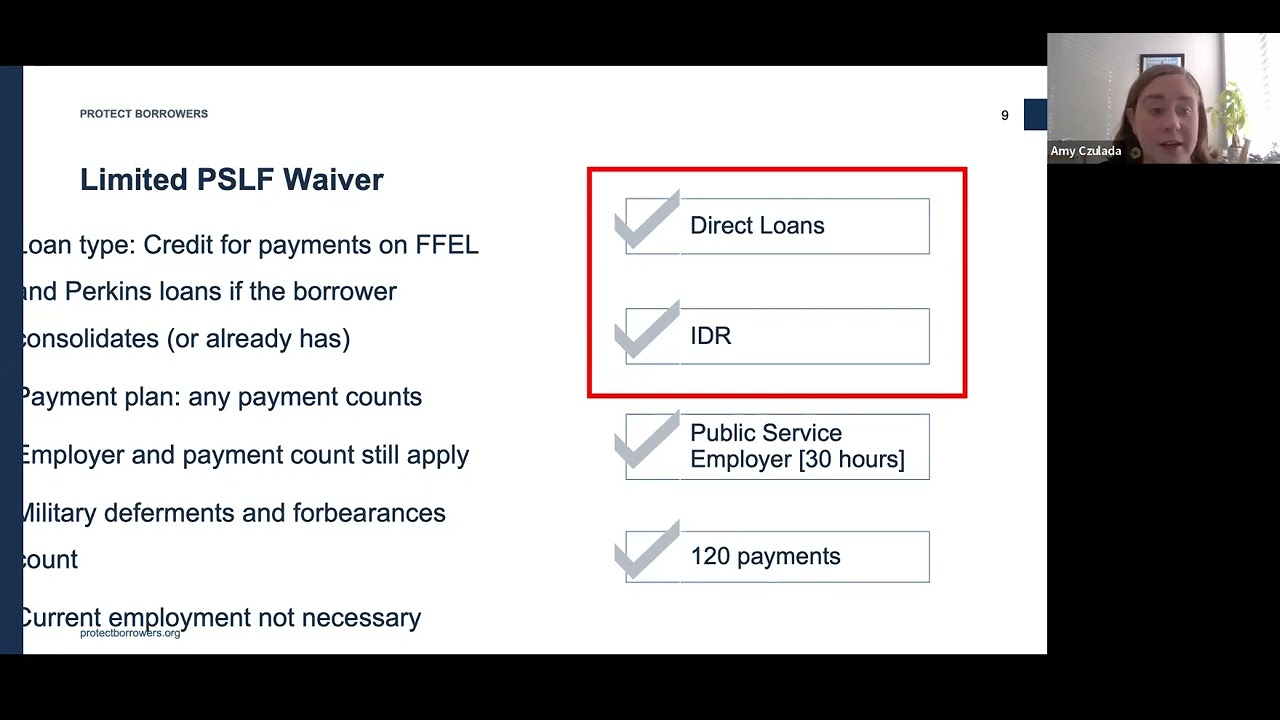

The administration has recently broadened the eligibility for the PSLF to include all federal student loans, as well as, for other programs, like the IDR programs through administrative action, since the congress is focused on other matters.

The aforementioned website is a good source with step-by-step instructions.

This is so frustrating to navigate when half of the info you are getting is accurate and the other half is not @glevenbach

You absolutely can consolidate FFEL loans into Direct Loans and the PSLF waiver should count all past payments on your FFEL loans as qualifying payments towards PSLF.

You can consolidate your loans directly through the Department of Education here:

https://studentaid.gov/app/launchConsolidation.action

This is a webinar we co-hosted about applying for PSLF through the waiver.

Thanks. Will check it out

Great Video. Thanks

Thanks.

Also dealing with choices for FFEL loans - forebearance is generally not helping, and is on the top of the list for servicers to promote because it extends the trap.

There are so many decisions to make about consolidation of FFEL loans. There are eligibility summaries through the free services such as SOFI to determine if it would be useful. As I owe over 6 figures, have paid tens of thousands, and still paying, work in public education, the recommendations I received were not to consolidate or switch services at this time. We are not alone, keep all documentation, write complaints at studentaid.gov, consumer protection & state attorney general’s office. Get help from experts, protect your credit rating.

Sorry there isn’t better advice yet on this.

Wow! I just applied to consolidate through student.gov last night. I’m curious as to why I wouldn’t want to do that. I think can still back out. I really haven’t paid anything yet. And my loans keep growing.

Zusammenfassend kann ich sagen, dass winaura einen sehr ausgewogenen Eindruck hinterlässt. Bei dieser Plattform https://win-aura.ch/ geht es nicht um starke Emotionen, sondern um Komfort und Stabilität. Genau dieses Format hat mir gefallen, bei dem Ruhe und Vorhersehbarkeit im Vordergrund stehen. Nach jeder Sitzung bleibt das Gefühl, dass die Zeit angenehm und ohne unnötige Anspannung vergangen ist. Ein solcher Ansatz ist selten, daher ist mir die Plattform gerade wegen ihrer Unaufdringlichkeit in Erinnerung geblieben.