Hi, yes please. I’d like to connect with someone to re-file. I was wondering if I should wait until the possible change in administration?

DTR, Defense to Repayment or Borrower Defense to Repayment.

Thanks for all the posts, I have some support coming online to this space to help answering questions. I will be back around Wednesday to post the call notes, and I will also start getting BuddySquads set up. Keep posting your questions and chime in if you have useful information!!!

when in doubt, check out the Get Help | Predatory Student Lending

New information to me. I would not be shocked at all. And that would also be a good case to call DTR hotline and grill them on WTF is going on.

Hi Dawn,

I’d like to talk to a “BorrowerBuddy” if possible. Thanks!

Nina

Hello,

I am reaching out as I have also received a denial from my DTR which was submitted in 2016. Apologies, but I was not able to make the calls when this was discussed. Could you point me in the right direction as what should be the next steps? I am willing to help in any way I can.

Sincerely,

Ryan Bailey

Hi,

I would like to reapply for loan forgiveness. I went to ITT Tech and my loan forgiveness was denied in July. Can someone help me with the paperwork?

Thanks,

Dawn Pfarr

Here are notes from the DTR Borrower Defense calls 8/21/20.

We have another call we are hoping to coordinate for our members with the Harvard Law group. and will make a larger announcement when it is confirmed.

The most recent, post calls, report back from FB groups…is that DTR Borrower Defense new applications are still being denied quickly. There is not enough information to say this is for certain. Until there is more information, we think folks might want to consider waiting to resubmit a new application. Specifically if you are covered by the covid moratorium on payments. This is a personal decision that each person needs to make for themselves.

I am still going to setup buddy support. However, we want to have clear and consistent information before we support folks in submitting a new application. Stay tuned and I will be emailing folks to connect you to support before the end of the month.

That is all for now, update as of 9/8/20.

Solidarity!

dawn

Call notes are from the session we had 8/21/20:

Thomas- Ok, I’m going to dive in, what we know right now and what next steps are right now. As you know some people have gotten their debt discharge through the DTR process. However, moist people have been denied. I want to stress that the people who have been denied have not done anything wrong. As far as we can tell the DOE is not even reading DTR’s submitted. The only thing they are looking at is the program you went to and the dates. They are trying to deny absolutely everyone but there are a few specific cases, primarily Everest cases, that because of actions of prior administrations, have forced the DOE to approve. Even in those cases there are some people who are only being given partial discharge or are told they have a 0% discharge. The DOE is not operating in good faith. They are going to make this as difficult as possible and force it to be fought out in the court. It’s going to be a long, drawn out process. So right now, what do you do if you receive a denial? There is a request for a reconsideration. My sense is if you fill that out, they aren’t even going to look at it and you will probably never hear from them again. It doesn’t matter what you say, no magic words that will make them give you a discharge. They are just denying everyone they can. But if you read the notification, there is a section that says, can I apply for borrower defense if I have additional claims. Based on conversations Dawn has had with reps and borrower defense hotlines, we think the best course of action would be filling out a brand new DTR application. Be honest, give all info you can. As you are submitting your new application, you can again request administrative forbearance, a stopped collection status. While we don’t think this will get you a discharge any time soon. We don’t know what’s going to happen in the election. We can assume if Biden wins they are going to take another look at the borrower defense process and it’s our hope they will discharge more of them but we don’t know. Trump could win, we just don’t know. But in the meantime it prevents your account from being in repayment status. The other thing I should say is that I don’t feel 100% confident that this will work. If you file a new DTR application and your account does get put into a repayment status, get in contact with us and we will try to figure it out. We can’t guarantee anything but we will do everything we can. I’m going to put my email in the chat. I know a lot of you have already forwarded me your denial, if you haven’t please do. We are sending them to the Project For Predatory Lending at Harvard. They are trying to review all of the denials they possibly can so they can figure out a legal strategy. I know it feels discouraging but in a legal sense we couldn’t actually sue DOE to force them to discharge your debt as long as your application was just pending forever, they were just about delay delay, it stopped us from advancing in the courts. Now they’ve started denying these claims we can sue them about the denial. In a way it’s progress even though it feels really awful. So forward me your denials. I’ll forward it along. Otherwise, we think starting from scratch and just resubmitting it, knowing that it doesn’t matter how you fill out the form, is your best bet. I want to dispel the myth that if you would have said something different you might not have been denied. They are not operating in good faith and are just denying everyone. So I wish we had more answers or better news but that’s the best information we have at the moment. Questions?

Dawn- For all of you questioning oh I should’ve put this, I should’ve submitted more pages, it is not you! This is a law that was for borrowers that were defrauded. That’s all it is. You don’t have to be an attorney to fill this out. They also have strategies. Like going section by section and denying them. That makes you feel like if you’d have put something different maybe it wouldn’t have been denied. That’s a strategy. That could be an automated response! I just want to stress that again. Just go through the process and reapply. Don’t worry about providing reams of docs.

QUESTION: Wondering if it would be helpful at all to contact the judge that ruled against DeVos and inform her about the DTR denials? I don’t know, just wonder if that would help?

Thomas- So Judge Sally Kim ruled in Velasquez vs DeVos case, will have to look up info on that case. You are correct in assuming when these challenges occur they may not go to the same judge. Reason these denials have happened is a result of the Sweet vs Devos case, the settlement has not been finalized yet and all of you are covered as class members in that. You have the option to object to the settlement. You may have gotten emails about that. In that case I think it is absolutely legitimate for the judge to hear from you, that hey look DOE is not operating in good faith. They aren’t reviewing anything, just denying. Maybe if the judge hears from thousands of you of what’s going on, it might inform how they are going to deal with this settlement. Maybe even adding some additional requirements from DOE. We are planning on hosting a larger Zoom webinar with Harvard. They would be much better at answering these questions than I am. As far as mentioning these court cases when you resubmit your application, it wouldn’t hurt, but I also don’t think it will make a difference.

QUESTION: I run a tiny facebook group, AI Alumni against loans. A lot of folks are having issues because we were told recently that if we resubmit and it’s just like the first submission, using the AI bait and switch, that the system will know and just auto delete. I was wondering if you guys know how to get around the auto deletion problem?

Thomas- Who told you about this auto deletion process? Was that the DOE hotline?

Corina- Yes, I had called them to get a copy of my denial. The guy told me not to write anything close to what I had written originally or it would be deleted as a copy.

Thomas- So this is a great question. The only question I have is the actual language of the application, doesn’t mention this. There is nothing on there about automatically deleting applications if it’s a copy. Just fill it out honestly and completely. As much detail as you can. Doubtful you would say the exact same thing in the exact same way as you did before. At the same time I don’t think they are actually going to look at it. My suspicion is it will sit on a shelf gathering dust, and whether or not any action is taken might just depend on the election in November. That being said, if you run into a problem saying your application was deleted because it’s a duplicate or anything like that, reach back out to us and we’ll do whatever we can. Try to figure out options. Until that time, I honestly don’t think they are even going to look at it. We don’t know.

QUESTION: I don’t know if there is anyone else from ITT Tech, a post on ITT group mentioned something about compromise and settlement. I was just wondering if that is something different that is being planned.

Thomas- Borrower Defense process is specifically for people that were defrauded by their schools. And we know there was enormous amounts of fraud at ITT. We have reams of affidavits and evidence gathered. So as you are filling out your application to resubmit I highly encourage you to go to the Project on Predatory Lending website and download all of those pdf’s, there are 100’s of them, and attach them to your application. But compromise and settlement is a totally different thing. Basically congress has already given the secretary of Ed authority to waive student debt for any reason whatsoever. When Elizabeth Warren was running she had promised to use this tool to do everything she could. It wouldn’t cancel student debt but it would cancel about 40 percent of it. So basically that means tomorrow, tomorrow, Betsy DeVos could cancel your student debt. Now we know Betsy DeVos doesn’t want to do that. But she has the powers. We don’t know who the next Secretary of Ed will be but if Biden wins and you are still in debt, it’s because Biden wants to keep you in debt. This is where we feel like we have a lot of power as organizers as debtors. Because we are in a great depression, we want to stimulate the economy and here’s an easy way to do it. Members of congress want to stop them from doing it. They don’t need to give her authority. Congress already granted her the authority, she doesn’t need congress’s approval again. That’s the task, we are organizing a strike for everyone, I will post URLs. After you fill out a new Borrower Defense Application, come join the strike. And give Joe Biden absolute hell. Tell him to cancel student debt.

Just saw on Brooks advocacy facebook group that the deadline on the Sweet vs DeVos case was yesterday.

Thomas- Ok, I apologize, I wasn’t aware. If that’s the case, we are stuck with whatever the settlement is.

Dawn- Ok, I want to jump in here. I saw in the chat, a comment that if people could share how they did that, it would be helpful. So I want to say that our community forum, that space is a living system. It requires people to engage in order to be useful. If anyone is interested in sharing information there we can nestle these tips in there for people. Sharing information and resources is going to be critical. Like a buddy system, right. We are buddies and share and support one another. Anyone need to talk?

QUESTION: I just wanted to talk a little about Sweet vs Devos, my lawyer has been following this cosely, and speaking to Teresa. I don’t see why we would want to object. I ended up getting denied then I got my interest back, like 16k. What Sweet vs Devos was supposed to do is they are paying back interest that accrued during the 4 years since I had filed, due to the delay.

Thomas- So we do have public statements from high ranking officials at DOE, because it was taking so long to make decision on DTR, that if you had waited more than a year they were supposed to waive the interest. In terms of moving forward, I have never seen that interest waiver show up as policy, just seems to be a decision they made. If you file a new application, I don’t know what would happen to the interest. If that is a concern for you, I don’t know, depending on what your household situation is, income situation, you may want to apply for Income Based Repayment that could lower your payment to zero a month. Then you can be banking those zero dollar payments as you wait for the application to play out. Some people will qualify, some won’t.

QUESTION: For the Sweet vs Devos that ended yesterday. I see the emails to lawyers and the clerk to the court, maybe we should still send objections to them? With mail problems and such lately maybe we can still push them through. I don’t know.

Thomas- Yeah I don’t know either. My guess is once the deadline passes they will not consider it. Each one of the lawsuits is a specific part of the puzzle. Now we have to create a new lawsuit about the denials. Not holding out a lot of hope that the settlement could be even better.

(shoutout @for_profit_colleges)

To Dawn L.: Are you from Las Vegas N. V.?

Hello Dawn and The Debt Collective,

Thank you very much for the email and the notes on the group call.

My own personal school experience will require other former students to submit testimony in support of my DTR. This is the case for all other students at the other acupuncture schools.

I am interested in what Harvard’s Project does moving forward. Students like myself with experiences in very small schools engaged in predatory lending schemes need organized legal assistance. Such assistance is high investment for the sake of a small group of for-profit school victims. For this reason I have had little to no chance to advance a very straightforward class of students.

Please keep me in the loop. If there are any other groups of lawyers who are interested in digging into different schools and their particular forms of predatory lending - I’d be interested in hearing about it. A student like myself has a better shot at making my experience into a book rather than a DTR application. Unlike places like ITT and Everest, the small cultish vocational schools make for interesting stories but difficult legal cases. Thats my perspective.

I have definitely learned that one of the reasons the for-profit education fraud explosion happened that few speak about is the fact legal aid offices don’t take educational fraud cases.

Thank you for all the organizing. I would encourage more very public lawsuit campaign by the PoPSL when you speak to them.

Cheers,

Benjamin Merrill

Hello folks,

Here is another quick update for those that are following the topic of Borrower Defense (DTR) denials.

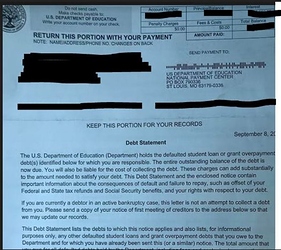

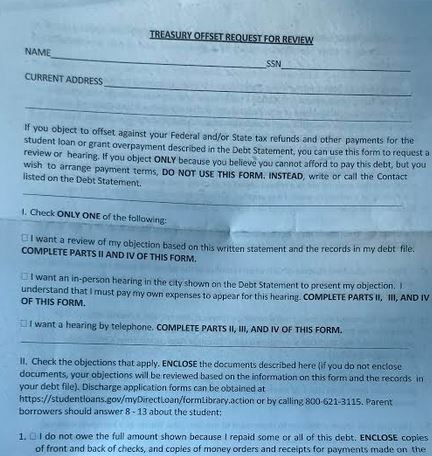

We are seeing that, YET AGAIN, the Department of Ed and their thugs (aka Servicers) are sending out mass notices. They are sending out something that looks like a bill for the full loan amount and a notice to dispute a tax offset.

(example of recent notices)

We have called the Borrower Defense Hotline and Default Resolution Group (servicer) and confirmed that these notices should not be sent out. There is a Federal Moratorium in place; 0% student loan interest rate and suspension of payments on federal student loans owned by the Department of Education (ED) until Dec. 31, 2020.

If you are worried or confused, you should call and check on the status of your loans. It is your right to request something in writing from your Servicer or BD Hotline that says you are okay. And! you should keep all this for your records.

You can also share your experience with the Student Borrower Protection Center(Borrower Defense Borrower Response Form - Student Borrower Protection Center). They are interested to know about this type of malicious harassment against people that have filed a Borrower Defense.

Please stay tuned for more updates on the Webinar and the Buddy System plan. We are actively working on this and need to make sure we have the most up-to-date information. Look out for posts here on the Community Forum and Email Announcements.

And always, feel free to post your questions, concerns, thoughts to the group .  You are not alone.

You are not alone.

Thanks Dawn L

I would like to get involved

David J Pratt

Hi @ScammedByAcuSchools, I know we have emailed back and forth before.

The main thing I want everyone to understand is that they have done nothing wrong. Even if you got every other student at your school to submit testimony as a part of your DTR I don’t think the Department of Education would even read it. They are operating in bad faith.

I don’t really know what the legal strategy will look like moving forward. It is possible that new developments in the Sweet v DeVos settlement will change the options available, but we don’t know yet. Here is an article about that

It is possible that their will end up being one big lawsuit about the denial process. It is also possible that it will have to go school by school or state by state. I really don’t know. I’m not sure that the lawyers at Harvard know what the right strategy is yet and are still thinking it through.

New at this and struggling to get caught up.

Is someone available for me to call and get started?

Gail Davis

Do you have Thomas’ email so I can forward my denial?

Gail, keep tuned in and we will be announcing another group call soon. We are confirming folks and will post here when details are available.

Dear Thomas,

Thank you for the message.

I believe I understand the characteristic of unlimited possibilities occurring due to the constantly morphing legal and financial situation in the US.

It would be great to see lawsuits that name every individual actor from Betsy DeVos to every person getting a paycheck from every little strip-mall predatory for-profit vocational school. Since these are crimes committed by bad faith actors, I think lawsuits are ultimately the correct response to the actions of all of the people and businesses involved at every level.

Lawsuits are the best way to both confront and describe these crimes from my perspective. A lawsuit addressing the criminal nature of DeVos’s mass denial of DTR applications should be immediate. But the multiple types of coercion occurring throughout all of the different education sectors needs to be broadcast. I am sure that the scandal of fraud and bid-fixing for the online public education platform contracts is just around the corner.

The legal profession is methodical by nature but there is no point in a genteel public approach to the savage level of fraud consuming the US business culture. The power of predatory actors in the federal government is solidifying barriers to accountability at an alarming pace. As is the case with many other sectors of the culture under assault, there is really no such thing as a “too aggressive” public awareness campaign or legal action to confront fraud right now. The pace at which individuals are experiencing economic fraud is accelerating at a frightening pace. It seems normal now to receive notices of identity theft.

I just want the advocacy agencies to think in a much more aggressive pro-active and confrontational way. I appreciate the work of the Harvard associated individuals. I hope they understand that this moment may require both a lawsuit that confronts the personal criminality of political appointees and a very direct media campaign against this predatory federal administration and the criminals who benefit. I would hope that the experiences of people inside the education department are being investigated.

Thank you for your work.

Cheers,

Ben

Yes. Great!

I filed my borrow defense application in 2019, and have yet to hear a decision. I followed up yesterday to check the status and was told that my application is next in the queue. No tentative date for review could be shared.

Any feedback or guidance, please let me know. I would like to join the call.

when are you going to have another meeting about private student debt?

I live in Georgia, one of the states that sued Navient. I fit the criteria for the loan cancellation, yet Navient says they will not cancel my debt