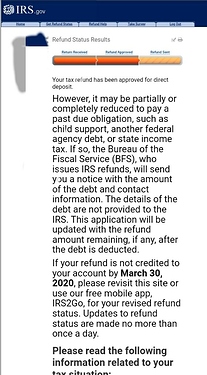

I just went online and checked my refund status, approved and processed. Except I won’t be getting any of it, as I have delinquent loan debt. At this point in time with current events as they are with holds on student loan payments and a $1.3 trillion stimulus package just hours away from being signed into law. I guess it was just too much to hope that federal tax return garnishments would be waived as well. I still have hope for a stimulus check, but only time will tell…

Hi @BFLYBOY79,

A lot is in flux right now so it is hard to say what might be possible here, but I would at least TRY to get this tax refund issued to you.

The first place I would try is simply calling the Treasury Offset Program at 800-304-3107. Given everything that is going on right now they might be able to give you the most direct answer as to whether getting a refund is possible or not given the crisis and what you would need to do to get one. I would expect to wait on hold a long time right now so carve out a few hours to do this.

Have you filed a borrower defense to repayment? If so, they shouldn’t have taken your tax refund at all and you can dispute that using the Debt Collective’s tool here: Tools and Services — The Debt Collective

If you haven’t filed a borrower defense to repayment, you can still dispute the tax offset but there is a different process. You can go through your student loan servicer to request a hearing to dispute the offset. This can be done based on hardship (lots of paperwork involved, but worth trying).

We are also organizing a student debt strike which you should join and spread the word to everyone you know: strike.debtcollective.org

Call your Senators and Representative and demand that any stimulus package include full student debt cancellation. You can find yours here: Organizing to win College For All

I hope this helps.

-Thomas